American Express Business Cards - Types of Cards

A difference must first be established between the three types of cards issued by American Express:

- Consumer Cards: for individuals

- Corporate/SME Cards: for small businesses or the self-employed (the subject of this article)

- Corporate Cards: for large companies

As a result, American Express Business Cards have a much wider audience than American Express Corporate Cards.

As soon as an individual generates business income and expenses… he or she may be eligible for an American Express Business Card.

No need to be incorporated to be approved for this type of card.

Therefore, this is convenient for small business owners, more commonly known as sole proprietors.

American Express Business Cards - Business Card Application Process

There are three steps to signing up for an American Express Business Card:

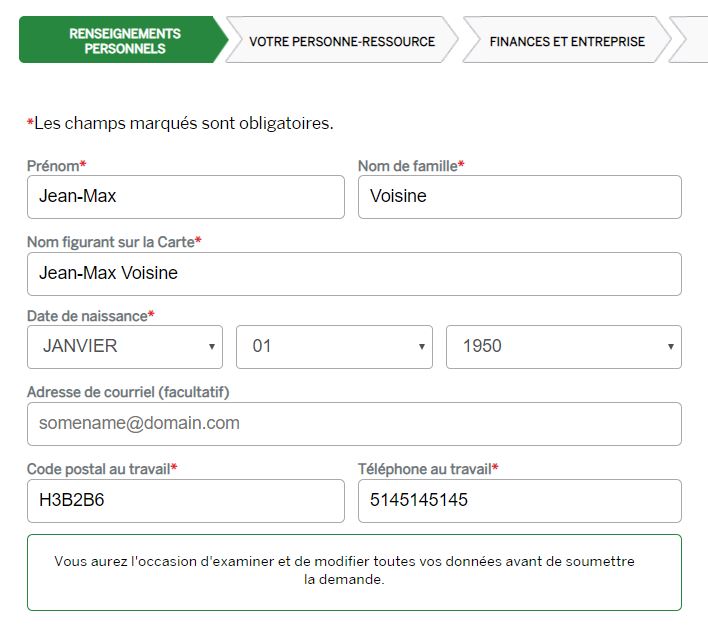

Step 1: Personal Information

Here will be your personal information and what will be written on your card.

By entering your email address, you can be notified directly of the status of the application (and resume it if you stop it in progress):

- First name, last name,

- Date of Birth

- Zip Code / Work Phone

For this last line, if you work from home, enter your home address.

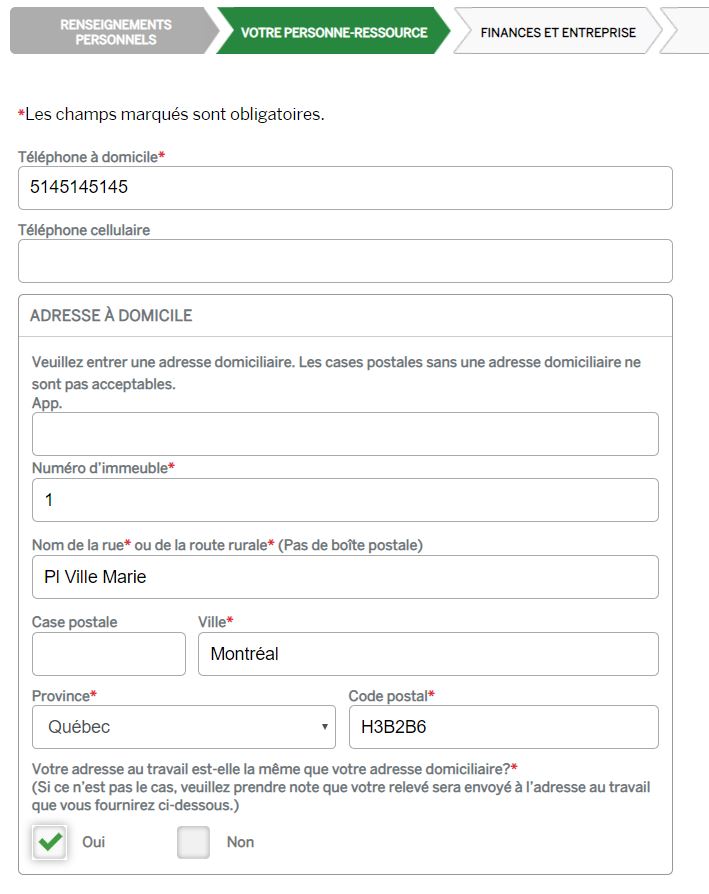

Step 2: Contact person

This is primarily your personal information so that American Express can contact you AND send you your card and statements:

- Home Phone

- Home address

If you work from home, indicate that your work address is the same as your home address by checking the box provided.

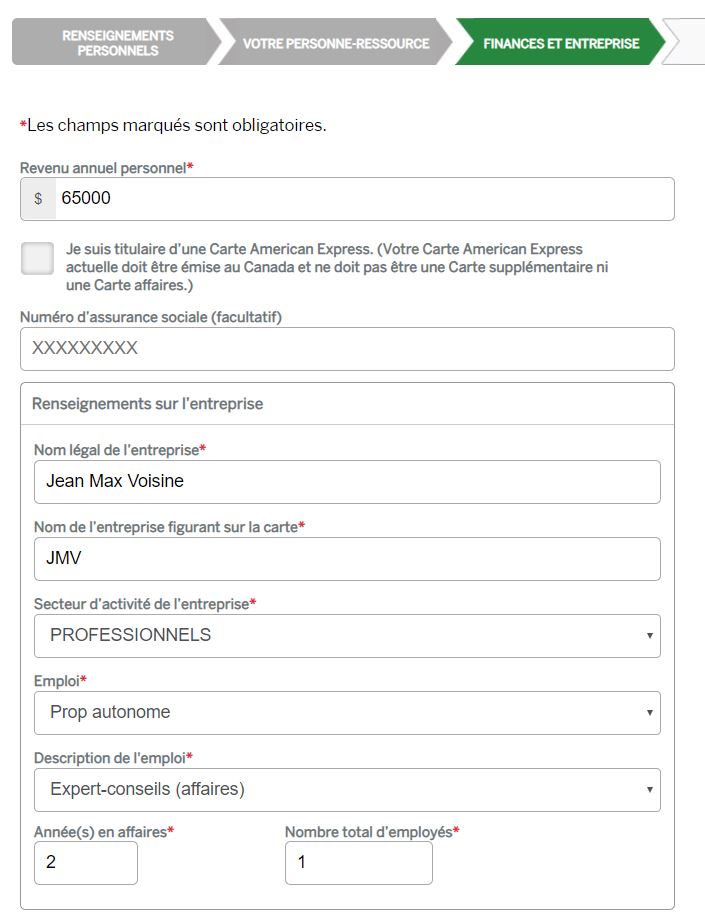

Step 3: Finance and Business

This is the most important part: we go into the details of your professional activity and your personal income:

- Personal annual income

- Business Information

You are free to provide or not your Social Insurance Number or the fact that you already have an American Express Card.

If you operate a sole proprietorship ( = self-employed), you can enter your name as the “legal name of the business .”

You then choose the industry that is closest to your business.

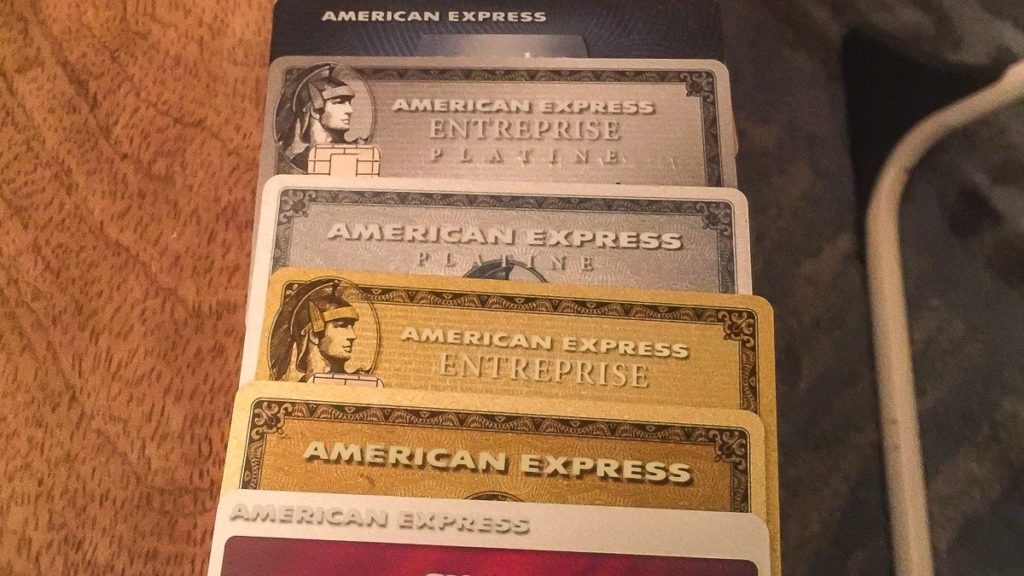

American Express Business Cards - Can I have more than one American Express Business Card?

This is a recurring question.

Yes, it is possible to have several American Express Business Cards.

However:

- Space card apps at least 6 months apart

- Keep active each of your Cards

Why would American Express grant you a new Business Card if your current card has no activity?

American Express Business Cards - The Best American Express Business Cards

Now that you know how to apply for an American Express Business Card, let’s look at your options.

American Express offers Business Cards in three loyalty programs:

American Express Business Cards - American Express Membership Rewards

American Express Membership Rewards Cards are the best-known American Express Business Cards:

Each of these American Express Business Cards has its specific advantages.

What brings together the Business Platinum Card® from American Express and the American Express® Business Gold Rewards Card®: these are Charge Cards. So there are no pre-set limits, which can be handy for a company with many expenses.

It is also possible to maximize cash flow through a period of up to 55 days without interest.

If you prefer a Credit card offering Membership Rewards points, opt for the American Express Business Edge™ Card. This is the best American Express business credit card for entrepreneurs who buy a lot of gas or office supplies.

Business Platinum Card® from American Express

Earn up to 120,000 points with this welcome offer for the Business Platinum Card® from American Express:

- 80,000 Membership Rewards® points after you charge $15,000 in net purchases to your Card in your first 3 months of Cardmembership

- 40,000 points when you make a purchase between 14 and 17 months of Cardmembership

You can use your Membership Rewards points in many ways:

- Transfer points to airline partners: Aeroplan, Avios (British Airways / Qatar Airways), Flying Blue, Delta Skymiles, etc.

- Transfer points to hotel programs (Hilton Honors, Marriott Bonvoy)

- Redeem points for statement credits to offset any eligible purchase charged to your Card (1,000 points = $10)

- And more!

120,000 points have a minimum value of $1,200 for a statement credit and much more if you transfer your points to a partner.

With this Card, you earn 1.25 Membership Rewards points per dollar on all purchases. What’s more, you’ll enjoy a host of travel and business benefits:

- Complimentary and unlimited access for you and an additional traveller to over 1,300 airport lounges worldwide.

- $200 Annual travel credit

- $100 Card Statement Credit for Nexus

- Marriott Bonvoy Gold Elite status

- Hilton Honors Gold Status

- Access to the Fine Hotels & Resorts program

- Up to $120 in eligible Wireless Credits each year

With this Card you can maximize your cash flow with up to 55 interest free days. It is a card that is particularly appreciated by contractors when making large purchases in home improvement stores, for example.

Last but not least, the Business Platinum Card® from American Express is distinguished by the numerous insurance coverages it offers: theft and damage for rental cars, travel accident from $500,000Emergency medical expenses (out-of-province or out-of-country), lost or stolen baggage, flight delays and misdirected baggage, hotel or motel burglary, Purchase Protection, Purchase Security.

Like all American Express Canada Cards, there is no minimum income requirement.

American Express® Business Gold Rewards Card®

Earn up to 110,000 Membership Rewards points with this outstanding limited-time welcome offer for the American Express® Business Gold Rewards Card®:

- 70,000 Membership Rewards points after $5,000 in Card purchases within the first 3 months

- 10,000 bonus points when you charge $20,000 in net purchases to your Card account each calendar quarter (up to 40,000 Membership Rewards points)

With this Card, you earn 1 Membership Rewards point per dollar on your purchases.

You can then use your points in many ways:

- Statement credit for travel purchases

- Statement credit for all purchases

- Transfer to partner programs (Aeroplan, British Airways Executive Club, Delta Skymiles, Flying Blue, Marriott Bonvoy, Hilton Honors, etc.)

- Book your flight with American Express Travel at a special rate

Also, as a cardmember, you get many advantages such as up to 55 interest-free days to maximize your cash flow.

Finally, you are covered with reliable insurance for your travels and purchases.

Like all American Express Canada Cards, there is no minimum income requirement.

American Express Business Edge™ Card

The American Express Business Edge™ Card is an excellent credit card for businesses in Canada. The annual fee is only $99 and this American Express credit card offers up to 67,000 Membership Rewards points in the first year, a value of $670.

You can also transfer your points to airline partners (Aeroplan, British Airways Executive Club, Flying Blue, etc.) and hotel partners (Marriott Bonvoy, Hilton Honors).

With this Card, you can get 3x the points on purchases:

- Office supplies (Staples, etc.)

- Electronic (Apple, Dell, etc.)

- Rides

- Gas

- Eats & Drinks

Besides, you can add up to 99 supplementary cards at no cost.

Like all American Express Canada Cards, there is no minimum income requirement.

American Express Business Cards - Marriott Bonvoy

The Marriott Bonvoy® Business American Express®* Card is the only business credit card in Canada to offer benefits and points for hotel stays.

We recommend it for entrepreneurs or sole proprietors members of the Marriott Bonvoy program who already have the Marriott Bonvoy® American Express®* Card for their personal needs. For example, you can get two Free Night Awards every year with these American Express credit cards!

Marriott Bonvoy® Business American Express®* Card

The Marriott Bonvoy® Business American Express®* Card is the best credit card for travelling self-employed professionals and small business owners.

With this exceptional limited-time welcome offer, you can earn up to 90,000 Marriott Bonvoy points:

- 75,000 Welcome Bonus Marriott Bonvoy® points after you spend $6,000 on your Card in your first three months of Cardmembership.

- Plus, earn an additional 2 points for a total of 5 points on every $1 spent on eligible gas, dining and travel purchases in your first 6 months (up to 15,000 points).

It’s the best time of year to get the Marriott Bonvoy® Business American Express®* Card. Don’t wait, this offer ends on May 6, 2024!

It’s a Card we recommend keeping because each year at renewal, you get an Annual Free Night Award (for up to 35,000 points at hotels worldwide) and 15 Elite Night Credits per year, counting towards your Marriott Bonvoy Elite status.

With this Card, you earn 5 points per dollar on all purchases at Marriott Bonvoy properties. And you can earn 3 points per dollar on:

- Gas

- Dining purchases

- travel purchases

And 2 points per dollar on all other purchases.

Like all American Express Canada Cards, there is no minimum income requirement.

American Express Business Cards - Aeroplan

The American Express® Aeroplan®* Business Reserve Card is the best business credit card in Canada offering benefits for your Air Canada flights.

We recommend it for entrepreneurs who are members of the Aeroplan program and wish, for example, to have unlimited access to Air Canada’s Maple Leaf Lounges and earn 3 points per dollar on purchases with Air Canada or Air Canada Vacations.

American Express® Aeroplan®* Business Reserve Card

With this welcome offer for the American Express® Aeroplan®* Business Reserve Card, you can earn up to 90,000 Aeroplan points.

Here’s how:

- Earn 65,000 Aeroplan points after spending $10,500 in purchases on your Card within the first 3 months.

- Plus, earn an additional 25,000 Aeroplan points when you spend $3,500 in purchases in month 13.

With this Card, you earn 3X the points on purchases made directly with Air Canada and Air Canada Vacations. And 2X the points on hotels and car rentals. Everywhere else, you will earn 1.25X the points.

With this Card, you receive many Air Canada travel benefits, such as access to Maple Leaf Lounges in North America for you and one guest, priority check-in, priority boarding and priority baggage handling.

Enjoy your first checked bag free (up to 23kg/50lb) for up to 9 people travelling on the same reservation on Air Canada®* flights.

Like all American Express Canada Cards, there is no minimum income requirement.

Bottom Line

As you can see, you don’t have to be the head of a large company to get an American Express Business/SME Card.

This will allow you to better separate your personal expenses from those of your small business: something to delight your accountant at the end of the year!