Introduction to points and miles

This guide presents an entire course on how to travel for free or almost free with credit card rewards program points. At milesopedia.com, you’ll find a lot of information to digest, but many before you have gotten there. Why not you?

Go at your speed. And if you want to receive our weekly tips, sign up for our newsletter!

Do you prefer a video tutorial? It covers the B-A-BA often discussed on the Milesopedia Facebook community.

By way of introduction, here is what you need to know first.

Many people don’t understand this:

All credit cards offer rewards or benefits compared to debit cards or cash.

For example, access to airport lounges, free hotel breakfasts, travel insurance or cash back.

In addition, credit card points allow us to save on most major travel expenses:

Airline tickets, hotel nights, Airbnb rentals, car rentals, theme park admissions, and foreign currency expenses.

Some credit cards also allow us to earn cash back to lighten our monthly budget. For example, clever Milesopedia members put this cash back into a travel account, enabling them to improve their budget when it’s time to leave.

Debit and cash payers partially subsidize the rewards and discounts that good credit card users receive. Because they pay the same prices for their purchases as we do but are not rewarded.

|

Remember the two main rules to become the perfect point hunter:

|

The goal: the starting ligne

Define your goal before switching or applying for a credit card to earn points. That is the starting point. How do I want to use the points I earned?

- An all-inclusive trip or a trip to Disney World?

- A road trip in Europe with multiple hotels or Airbnb rentals?

- Savings on foreign currency purchases?

- Saving money with cashback?

Where to start:

1- Define your goals

2- Implement your strategy. Choose the relevant reward programs for your plan. We recommend focusing on one or two programs at most at the beginning.

3- Compare credit cards to each other to set up your earning strategy. To find those adapted to your profile and your projects. You’ll find almost 200 cards presentation on our comparator! Milesopedia guarantees you a simple, reliable and efficient credit card comparator.

Visit our testimonials section: all those who have shared their successes with points and miles… started with a specific goal in mind!

1- Credit cards

If you prefer a video course, here it is! Otherwise, continue reading.

Credit card networks

There are three major networks on the market:

- American Express

- Mastercard

- Visa

Each network will offer banks different types of products :

- credit or charge cards

- Mastercard, World or World Elite cards

- and Visa Classic/Gold/Platinum, Infinite and Infinite Preferred.

These products have different features:

- Minimum age

- Minimum personal/household annual income required These prerequisites are not required by the banks but by the Mastercard and Visa networks.

- Benefits

- Insurance packages

It is then up to the banks to improve the products they wish to offer their clients:

- welcome offers

- benefits for card holders

- additional insurance warranties

These benefits make their credit cards more attractive than their competitors.

Types of credit cards on the market

The debit card

The debit card is attached to your checking or current account and is offered by a bank when you open a new account. Your current account is immediately debited when you make an ATM withdrawal or purchase with a debit card.

The debit card will generally not offer points benefits. Mastercard and Visa distribute debit cards.

The credit card

There are credit cards for:

- individuals

- professionals, self-employed individuals, small businesses

- corporations/big companies

The credit card is not linked to your checking account. The great benefit allows you to own credit cards from institutions other than your current bank/credit union.

The credit card has a limit that the issuer pre-sets, and it allows you to defer payment at the time of purchase.

However, a credit card balance carried over from month to month means paying a very high-interest rate.

The charge card

Some institutions, such as American Express, will issue you charge cards.

The payment card is not linked to your checking account. It has no pre-established limit known to the customer (only the issuer knows it) and allows you to defer payment with your purchase.

However, the balance on a payment card MUST be paid on each statement and cannot be carried forward for interest.

The prepaid card

The three networks offer prepaid cards: you will load the amount you want and use it the same way you would a debit card.

These cards may be helpful but unattractive to those who accumulate points. They do not generate any. They will be used, for example, to load money in foreign currency for a trip.

Example of prepaid cards: KOHO Mastercard Prepaid Card

The different credit cards

There are almost 200 credit cards in Canada, as you can see in our credit card comparator! In addition, Milesopedia has also established a ranking of the best credit card offers!

In this classification, there are several types of cards. We have categorized them in a side menu on the right. Here is an overview.

- no-fee credit cards

- student credit cards

- rewards credit cards (the ones we’ll be most interested in)

- credit cards for balance transfers

- corporate credit cards

Credit card fees

Annual fees

Annual fees are an integral part of the reward earning process. We could divide the types of annual credit card fees into 4:

| TYPE | EXAMPLE | AVERAGE COSTS |

| Basic card | Visa Classic | $0 – $50 |

| Standard card | World Mastercard | $50 – $120 |

| Premium card | World Elite / Visa Infinite | $120 – $150 |

| High-end card | Visa Infinite Privilege / American Express Platinum | $399 – $899 |

The most interesting cards will often be the standard/premium/high-end cards.

Although you have to pay an annual fee, the overall credit card benefits and the first-year sign-up bonus make up for the fees paid!

But it’s not uncommon for cards with no annual fee to have an attractive bonus, such as the American Express® Green Card.

Costs related to purchases, withdrawals, transfers

Here, we will discuss the fees applied by your institution in different cases, such as :

- cash advances,

- purchases made abroad/in foreign currency,

- exceeding the credit limit.

These fees are usually avoidable by managing your credit cards well or using the right cards wisely, such as a credit card with no foreign currency conversion fees.

Interest costs

Points and miles collectors are generally not known to have credit card interest charges! They pay their entire balance each month.

If you have outstanding balances on your credit cards, there’s no point in starting to earn rewards points: the interest charges paid will negate the benefit gained by the credit cards. The hobby is not for you. At least not yet!

Should you negotiate your annual fee?

It is essential to keep updated with current offers to be competitive when paying the annual fee. You have value to these lending institutions. However, your level of annual expenses or exceptional circumstances may or may not allow this fee to be waived.

I refer you to this article:

The perks of credit cards

Purchase protection

Three examples:

- Extended warranty: Double/triple the original manufacturer’s or dealer’s private label warranty for one year.

- Price Protection: If you find the same new item at a lower price within 60/90 days of a purchase made with your Eligible Card, you may be reimbursed for the price difference.

- Purchase Protection: Get coverage for most items you purchase with your eligible card if your item is damaged or stolen within 90/120 days of the purchase date.

Personal assistance

Two examples:

- Concierge Services: Get exclusive, personal assistance with dinner reservations, activity tickets, locating hard-to-find items, purchasing and delivering gifts, or obtaining services for your company.

- Helpdesk: Get assistance with any questions about your card anytime, anywhere.

Personal protection

Two examples:

- Zero Liability: Pay only for purchase charges authorized on your card account. You are not responsible for unauthorized purchases, such as lost or stolen cards.

- The chargeback procedure: it is possible to obtain a refund for a service/product not received and paid by credit card. For example, think of the cancellation of flights by the airline due to unusual circumstances.

Travel assistance

Two examples:

- International Help Desk: Get help virtually anytime, anywhere, in the language of your choice. Use your credit card services to report lost or stolen cards, get emergency card replacement or emergency cash advances, find out where an ATM is or if you have questions about your account.

- Access to VIP airport lounges Depending on the type of credit card, you may have free / paid access to airport lounges

Travel protection: credit card insurance

There are many types insurance coverage:

- Collision/Loss Damage Insurance for vehicle rentals. This insurance covers the cost of damage to or theft of your rental vehicle if you use your credit card eligible for this coverage to reserve and pay in full for the rental car.

- in case of accident and medical emergency. This insurance protects you and your family in the event of accidental death and dismemberment if you purchase your public transportation tickets using your eligible credit card. For added peace of mind while traveling, your credit card provides emergency medical coverage anywhere in the world for you, your spouse or dependent children traveling with either parent.

- trip cancellation. This insurance protects you and your family against lost, non-refundable or unused payments and deposits in the event of trip interruption or cancellation if you purchased your public transportation tickets using your eligible credit card.

- baggage delay. This insurance reimburses you for purchasing personal or business essentials if your checked baggage is delayed on a common carrier and you have paid for your transportation tickets with an eligible credit card.

- damage or loss of luggage. This insurance reimburses you for the repair or replacement of your checked luggage or carry-on bags that have been damaged or lost by your common carrier, and you have paid the total cost of your transportation tickets with your eligible credit card.

- burglary at the hotel or motel. This insurance provides reimbursement for the loss of your personal belongings due to a burglary in your hotel or motel room. Your stay at the hotel must have been paid in full by the means of an eligible credit card.

Special offers to cardholders

Some cards will offer experiences and offers.

Their holders will be able to take advantage of exciting offers from retailers, hotels and airlines.

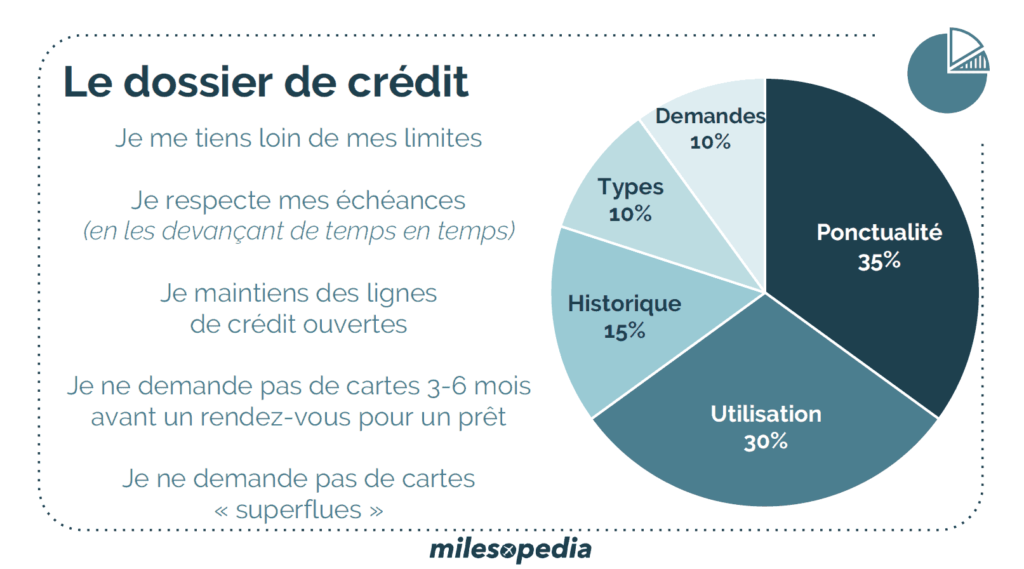

The credit report

When applying for a credit card, the card issuer will check your credit report and review your credit score, representing your current financial situation.

Two institutions will provide this information: Equifax and Transunion.

Credit history will compile various information such as:

- outstanding credits (house, car, etc.)

- employment history

- debts (late payments, NSF checks, accounts transferred to a collection agency, judgments, bankruptcies, etc.)

It is essential to know that a credit card application will only count for 10% of your credit score.

80% of your credit score is based on:

- payment habits (35%)

- credit utilization ratio (30%)

- credit history (15%)

The information may be retained for six years in your file.

To improve your score, we suggest that you pay off your balances as soon as possible rather than waiting until the end of your card cycle!

In conclusion, credit card issuers want to know:

- whether you are a good or bad payer,

- what your debts are,

- and have you been granted credit by other institutions?

What is the first credit card to apply for and start earning points?

The choice will depend on YOUR income and YOUR goal.

Thus, each point optimization strategy can be customized. We have prepared some for you in the last section

2- Reward programs

The companies you deal with every day, whether in the travel industry (airlines, hotels), banking, or everyday life, have created rewards programs to build loyalty.

There are 4 types:

- Airline Rewards programs

- Hotel loyalty programs

- Bank rewards programs

- Cash back Rewards programs

If you prefer the video course, here it is! If not, continue reading.

Airline Rewards programs

These are rewards programs that are closely or remotely related to an airline. In Canada, the best known of all is Aeroplan, Air Canada’s rewards program.

These programs offer miles you can use for:

- flights

- hotel nights

- Car rentals

- merchandise/gift cards

However, keep in mind that you’ll get the best return on investment when using these miles for flights.

Finally, it is typically advisable to be a member of 3 to 4 airline reward programs to cover the possibilities offered by the three major airline alliances:

- Star Alliance (Air Canada, United, etc.)

- Oneworld (British Airways, American, etc.)

- Skyteam (Air France – KLM, Delta Airlines, etc.)

The main rewards programs

Here are the major airline rewards programs:

Hotel loyalty programs

There are several major hotel groups worldwide, and each of them has rewards programs.

The best known of all is Marriott Bonvoy, for example, which provides access to over 8,000 hotels worldwide.

These rewards programs issue loyalty points that you can redeem for :

- hotel nights

- flights

- Car rentals

- merchandise/gift cards

However, you will get the best return on investment when using these points for hotel nights.

We recommend you be a member of all hotel rewards programs to cover all eventualities for your stays. Registration is free.

The best (and only with its “corporate” version) credit card for earning quick hotel points is the Marriott BonvoyTM American ExpressMD Card.

The main rewards programs

Here are the leading hotel rewards programs:

Bank rewards programs

Most financial institutions have their own reward programs.

We’ll talk about Bonusdollars at Desjardins, BMO Rewards at BMO, or Membership Rewards at American Express.

Obviously, each of these programs has strengths and weaknesses you need to know about.

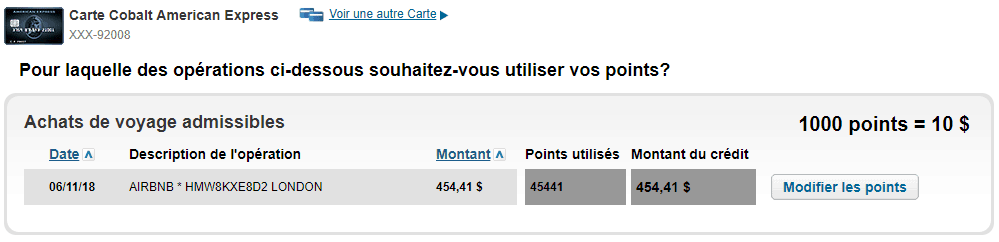

They generally deliver points that can be redeemed – for some – for :

- purchases of accommodation such as airbnb

- a credit to the credit card account

- products / gift cards

- transfers to another rewards program (usually air or hotel)

The main rewards programs

Here are the main rewards programs which offer travel points:

Cash back Rewards programs

Cash back Rewards Programs are mainly for those who don’t want to use the three previous types of programs.

AIR MILES CASH Rewards are part of this type of program. Many offers exist in Canada for AIR MILES credit cards!

These programs issue rewards dollars that are usually charged to your credit card account or that can be used to reduce your bill at the pharmacy, the SAQ or your gas station.

The main rewards programs

Here are the top cash back rewards programs:

Now you know the main rewards programs.

Are you ready for “Earn and Burn“?

3- Accumulate and use points

If you prefer the video course, here it is! If not, read on!

Reward Program Membership

Signing up for rewards programs is free.

And today, there are many technical ways to replace the plastic card or memorize your identifiers so as not to clutter up your wallet and memory! We’ll discuss those below.

Here are the links to the registration pages for the different reward programs useful for Canadians (excluding bank programs that depend on your credit cards).

The main airline rewards programs

| PROGRAM | DETAIL | REGISTRATION |

|

The most famous in Canada. It provides access to Star Alliance member flight rewards. You can earn Aeroplan points with many partners (shops, banks, etc.). Reward program guide. | Registration |

| This program provides access to flight rewards from Oneworld Alliance member airlines. The primary way to earn Avios miles is through American Express or RBC. Guide to the reward program. | Registration | |

| WestJet’s loyalty program’s leading partner is RBC. It gives you Westjet dollars. Reward program guide. | Registration | |

| Delta’s SkyMiles program provides access to flight rewards from member airlines of the Skyteam alliance. To obtain miles in Canada, it will be via American Express. | Registration | |

| A program of American Airlines, AAdvantage miles provides access to Oneworld Alliance member primes aériennes. These miles are earned in Canada through Marriott Bonvoy and RBC. | Registration | |

|

A loyalty program well known to Canadian consumers. It gives access to travel rewards (airfare, hotels, car rentals) and merchandise. You can earn AIR MILES Reward Miles with many partners. Reward program guide. | Registration |

| Best known in Europe as the joint program of Air France – KLM. This program can be helpful for specific flight rewards. Flying Blue miles are earned in Canada through American Express Membership Rewards. Guide to the program. | Registration |

The main hotel rewards programs

| PROGRAM | DETAIL | REGISTRATION |

|

Marriott Bonvoy issues points that can be redeemed at +8,000 hotels worldwide in all price ranges. Guide to the program. | Registration |

|

Best Western focuses on mid-range hotels and has over 4,000 hotels worldwide. Guide to the program. Our map of BW hotels in Canada. | Registration |

|

The Hilton Group offers 5,000+ hotels worldwide. You can earn Hilton Honors points with American Express. Reward Program Guide. | Registration |

| The Intercontinental Hotels Group is better known for the Holiday Inn and Crowne Plaza hotels. Program guide. | Registration | |

|

The European group Accor is becoming increasingly important in North America, particularly following the acquisition of the Canadian group Fairmont. Program guide. | Registration |

Major cash back rewards programs

Here are the best cash back rewards programs in Canada:

| PROGRAM | DETAIL | REGISTRATION |

|

A loyalty program well known to Canadian consumers. It provides access to travel rewards (airfare, hotels, car rentals, etc.) and merchandise. You can earn AIR MILES Reward Miles with many partners. Reward program guide. | Registration |

|

Scotiabank’s loyalty program offers several credit cards that earn Scene+ points, like IGA. | Registration |

|

PC Optimum is the loyalty program for Loblaw grocery stores (Provigo, Maxi, etc.) and Shopper Drug Mart drugstores. Program guide. | Registration |

|

Metro&me is the loyalty program for Metro grocery stores. | Registration |

|

SAQ Inspire is the SAQ’s loyalty program. Program guide. | Registration |

Tracking Rewards Program Point Balances

Signing up for dozens of rewards programs has one major drawback: multiplying the number of accounts, passwords, and point balances to monitor.

You could create your excel file as many milesopedians have done. Set up your budget, classify your expenses and do your calculations to get up to speed quickly on your points.

There are also tools to help you, like AwardWallet.

Don’t hesitate to register; its basic version is free (and reasonably sufficient for most users).

Earn points with your purchases

Every day you can earn rewards through your purchases or credit card application. And the opportunities are numerous!

- Use the right credit card at the right place and take advantage of gift cards in grocery and convenience stores!

- Buy via a loyalty program portal such as the Aeroplan eStore

- Use Rakuten to buy gift cards with your credit card (for your groceries, for example)

- Pay for your taxes (or any other supplier who only accepts cheques) with your credit card, via Plastiq.

Take advantage of credit card sign-up bonuses

Credit card bonuses can range from a few dollars to tens of thousands of reward points. We compile a monthly ranking of the best current offers.

For AIR MILES, check out the best credit card offers!

Learn how to use reward programs

Various pages are devoted to each rewards program, and practice will make you an expert in rewards programs.

4- Objective and strategy

Let’s recap. The essential steps to be able to build a strategy to travel for free or almost free:

- Set short-, medium- and long-term objectives

- Define the rewards programs you need to achieve your goals

- Apply for the RIGHT credit cards to quickly increase your points balance

If you’d like to watch this tutorial (with English subtitles), here it is. Otherwise, keep on reading.

Your goals: the starting point of your strategy

As we said above, set one or more goals for yourself! This is ESSENTIAL in order not to go hunting for points in all directions.

Examples.

- Short term: we want to to accumulate Marriott Bonvoy points to fulfill our need for 2-3 free nights on a trip that will be made in 3-6 months.

- Medium-term: we would like to collect many AIR MILES Reward Miles for theme park admissions and/or short-haul flight tickets for a trip to the Maritimes or the Northeastern U.S. planned in 6-9 months.

- Long-term: we want to to collect Aeroplan points for travel for trips we will take within the next 9-12 months.

A short-term objective: 1 to 6 months

Hotel points?

Rapid earning of hotel points can cover a travel need in 3-6 months.

In 3 months, the Marriott Bonvoy® American Express®* Card can quickly get you 10+ free hotel nights depending on the Hotel categories and season.

And double up by also applying for the Marriott Bonvoy™ Business American Express® Card.

Cash back?

Significant expenses in the next three months? Think cash back!

Good credit cards to start with are these, in particular, the BMO World Elite Discount Card.

High bonuses?

Quite a big expense is coming up (municipal or school taxes, etc.)? Take the opportunity to unlock welcome bonuses from cards that require spending $3,000+ in 3 months!

This is currently the case with both BMO World Elite credit cards.

A medium-term objective: 6 to 12 months

Hotel points

You can make a strategy with your Significant Other or a friend to earn many hotel points or airline miles!

The goal is to afford a trip in six to twelve months (or more). This is what I did with friends, for example, six to twelve months before going to Thailand in business class!

Travel points

We will use different cards belonging to a travel points program to increase our points balance, in order to earn a bonus!

For example, BMO Rewards points via the five cards part of the program, or Scene+ points via the five co-branded credit cards!

A long-term goal: twelve to twenty-four months

Your long-term goal should be for the next twelve to twenty-four months.

Hotel points

We’ll earn American Express Membership Rewards. American Express Membership Rewards are the most flexible, offering you a wide range of transfer partners (such as Aeroplan, British Airways Executive Club, Delta Skymiles, Marriott Bonvoy, etc).

And these points have virtually no risk of loss of value (whereas other programs may be “devalued”).

American Express offers 7 cards with Membership Rewards!

With the many Membership Rewards earned in one year, purchasing flight rewards for yourself and your family for the following year is possible.

As loyalty programs continuously evolve – and we are not immune to points devaluation – the long-term goal should not exceed 18 to 24 months.

For example, Aeroplan had announced an end date for its partnership with Air Canada effective June 30, 2020. But that changed, and Air Canada acquired Aeroplan.

Choose the right rewards programs for you

In Canada, there are some great loyalty programs:

And other programs that will save you a lot of money. Let’s take a look at their strengths and weaknesses.

Aeroplan and your goals

Aeroplan is useful to book flights with flight rewards.

Aeroplan's Highlights Summary

Aeroplan as a lot of partners: from credit card issuers (American Express, CIBC, TD) to hotel partners (Marriott Bonvoy, Best Western Rewards, etc.), which makes it easy to earn miles.

The Aeroplan program will be particularly effective for short- and medium-haul flights in economy class and long-haul flights in business class.

Aeroplan can also be a way to travel in the luxury of business or first-class at a lower cost.

Aeroplan's Weakness Summary

The fundamental weakness of the Aeroplan program is the point cost of the flights, which fluctuates with the dynamic pricing. If you have fixed travel dates (spring break/holiday season), it will often be challenging to find reasonably priced tickets, as these are popular dates. You have to get ahead of the game.

Besides, if you plan to travel to Europe in economy class, it will be wiser to pay for your flight as fares regularly run around $600. We will then use a program offering travel points to save money (see below).

AIR MILES and your goals

AIR MILES has two programs:

- CASH Rewards

- DREAM Rewards

AIR MILES CASH Rewards

The CASH Rewards program is straightforward. You can redeem your CASH Miles instantly in-store with participating Cash Partners.

Generally, we wait for a promotional period to redeem 75 or 85 CASH miles to get increments of $10 towards our purchases instead of 95 CASH miles!

The highlights of AIR MILES CASH Rewards

- Simplicity

- 85-95 miles = $10 rebate

With the past and future departures of major AIR MILES partners (IGA, Réno/Rona, Jean Coutu, Bureau en Gros…), it will be much more challenging to collect miles. The future of the program is uncertain.

AIR MILES DREAM Rewards

Short-haul flight rewards

Is your goal a short-haul flight (to a nearby province or U.S. state)?

AIR MILES highlights for short-haul airfare

- For destinations that are often expensive in money (Maritime…)

- You can book with many airlines (Delta Airlines, Porter, Air Canada, etc.)

AIR MILES’ weakness for short-haul flight rewards:

- it is necessary to take several months in advance to have a ticket with requested miles which are at “reasonable” prices

Using your AIR MILES is not worth it for medium-haul and international flights. Fees and surcharges completely erase the savings. To be avoided.

Great use of AIR MILES miles can be made for car rentals.

DREAM Miles for Vacation Packages/All-Inclusive

Would you like to redeem your AIR MILES DREAM miles for an all-inclusive vacation package?

AIR MILES Highlights for Vacation Packages:

No AIR MILES weakness if you prefer an all-inclusive.

DREAM Miles for Other Rewards

It is possible to redeem your DREAM miles for other rewards:

- Theme park tickets

- Hotels

- Rental cars

Summary of AIR MILES' strengths

The significant advantage of the AIR MILES program is that it has two banking partners, American Express and BMO, who issue 6 credit cards linked to the program.

Therefore, it is straightforward to accumulate many AIR MILES Reward Miles via the application bonuses. But it will be more difficult in the future to accumulate these miles through daily spending. Especially since Jean Coutu and IGA will no longer be AIR MILES partners in 2023.

Summary of AIR MILES weaknesses

You won’t use your DREAM miles for long-haul flights: you will not be able to get a fair value of your miles that way (a lot of miles and imposed surcharges). So forget AIR MILES to travel to Europe, Asia, South America, etc.

Marriott Bonvoy and your goals

Marriott Bonvoy is useful to get free hotel nights in nearly 7,000 hotels around the world. It’s the largest hotel loyalty program.

The highlights of the Marriott Bonvoy program:

- Credit cards available

- You can transfer Membership Rewards points to Marriott Bonvoy

- You can transfer Marriott Bonvoy points to airline programs

- Hotels available for as little as 5,000 points

- Stay for 5, pay for 4 when you pay with points

- A global footprint in more than 100 countries

- Status Benefits (room upgrade, complimentary breakfasts, etc.)

Marriott Bonvoy weaknesses:

Marriott Bonvoy Highlights Summary

Marriott Bonvoy is especially useful to get free hotel nights, but airline miles also!

It is like a “Swiss knife” for the miles and points traveller. In addition, two credit cards allow you to accumulate points quickly, AND it is possible to transfer 100,000 points from one account to another: this is particularly advantageous for a couple!

Find out how you can save on a trip to Disneyworld with Marriott Bonvoy.

Marriott Bonvoy's Weaknesses Summary

As you can see, there are no real weaknesses for this program! The only one we see is related to the extra costs automatically charged when you add more than two people in the same room.

To avoid them: just indicate two people and choose a room with two beds. 😉

American Express Membership Rewards and Your Goals

American Express Membership Rewards is THE best loyalty program for travellers with miles and points.

Strengths of American Express Membership Rewards

- Considerable points transfer partners

- Ability to use points for an account credit for any travel purchase

- Ability to use points for an account credit for any purchase

- A fixed fare schedule for certain flights that doubles the value of points

Weakness of American Express Membership Rewards

- American Express cards are less accepted in stores but it begins to change.

Summary of American Express Membership Rewards

The strength of the American Express Membership Rewards program is its great flexibility! This is especially handy if you decide to change your strategy along the way!

A welcome bonus of 50,000 American ExpressMD Gold Rewards Card Membership Rewards points can be used in many ways:

- 50,000 Aeroplan / British Airways points

- 60,000 Marriott Bonvoy points

- $500 account credit for any purchase

We highly recommend American Express Membership Rewards to people who would like to travel, or even those who prefer cash back!

Summary of American Express Membership Rewards

American Express is less well accepted in different shops than are Mastercard or Visa cards. However, American Express is gradually closing the gap with the Shop Small initiative: many small merchants now accept American Express cards.

The leading grocery stores that accept American Express in Canada are Metro and Super C. In addition, it is possible to buy gift cards on Rakuten (formerly known as ebates ) (with Paypal + American Express) for other grocery stores like IGA and Maxi. In addition, several grocery stores under the IGA banner have recently begun accepting American Express cards.

Other programs and your goals

Credit card issuers offer many other rewards programs. Each of them will have their pros and cons.

We suggest you choose a program offering greater flexibility to use points:

With most of these programs, you will save a few hundred dollars here and there: it can make a clear difference in a “travel budget.”

Apply for the Suitable credit cards

Now you know:

- How to define short/medium/long-term goals

- In which rewards programs you have to earn points

It’s time to build your credit card application strategy. To help you, you can check out our best credit card offers page.

This article is a beginner’s guide, so begin slow from the beginning with a max of one or two credit card applications!

The traveller's 'Swiss Knife' credit card

Often, in the Facebook group, the goal is often difficult to set and can evolve!

There is ONE card for this: the American Express Cobalt® Card!

We decerned it as the best credit card in Canada! All the cardholders are happy to have this card and let it be known on our Facebook group!

During the first year of ownership of the American Express Cobalt® Card in the first year of ownership, a minimum of 60,000 points, or $600 in account credit, can be earned on any purchase:

- You can earn 2,500 Membership Rewards points for each monthly billing period in which you spend $500 in purchases on your Card.

- And if you spend those $500 at a 5X multiplier store (groceries, restaurants, bars, convenience stores – don’t forget about gift cards), you can get 2,500 extra points ($500 x 5).

Here’s what you could do with those 60,000 points:

You can convert 60,000 points into 72,000 Marriott Bonvoy points

Use them as a credit to the $600 travel account

(plane tickets, hotels, airbnb, car rental,etc.)

Use as a $600 account credit for any purchase

Transfer them into 60,000 Aeroplan points

Whether you book hotels or Airbnb, or flights directly with any airline, the American Express Cobalt® Card is a proper Swiss Army knife!

5- Useful resources

If you’ve come to this section, you’ve managed to understand the principles and basics of earning points and miles! Well done!

This “Going further” section suggests readings from selected articles that will allow you to improve your knowledge of Reward Points! But, of course, you go at your own pace and according to your needs.

Basic rules with Reward Points

Mastering rewards and credit card programs require knowing the basic rules:

Essential articles on points and travel in general

Essential articles about Airport lounges

Strategies with Reward Points

Essential articles on family travel with points

Still not convinced?

The milesopedia community

Otherwise, there is nothing like talking to the only French-speaking Canadian points & miles community to become an actual points hunting expert!

The community often asks us to establish customized credit card rewards points strategies.

It is a delicate exercise because everyone has:

- different desires (economy class vs. business, hotels vs. Airbnb, nature vs. urban, etc.)

- different lives (single vs. couple, couple vs. family, etc.)

- different flexibilities (relaxation vs. retirement, salaried vs. self-employed, etc.)

- different means (students vs. high income, etc.)

- different expenses (large grocery stores vs. market, daycare costs, etc.)

In short, one size does not fit all when it comes to credit card rewards strategies!

The final word

All the new point hunters report it: what a lot of details to know! Yes. It’s a marathon in terms of both content and learning during the application.

All you have to do is reread, revise and try. Like all of us, there will be beginner’s mistakes, but our Facebook community will be there to support you if you want it. And don’t forget to sign up for our free newsletter so you don’t miss any of our tips and offers!

See our best credit cards for beginners. For those with a little more experience, read about our best credit cards for the intermediate level.

Happy hunting!